Philanthropy-it’s more than just the wealthy

Forbes contributor Katia Savchuk recently observed that financial donations of the wealthiest Americans dipped, especially during the recession. However, the “middle market” maintained their giving or stepped it up a notch.

What does that mean? It means that each of us can be a philanthropist – each of us has abundance and can create meaning in our lives through giving.

If you would like guidance on how to do that, please fill out the form below, and I’ll send you “On Purpose, With Purpose” – a guide to lifetime and legacy planning.

Your message has been sent

Philanthropy-it’s more than just money

The World Giving Index 2014 report has been released, and it reveals that people all over the globe are unleashing the abundance in their lives in many different ways. Charities Aid Foundation of the UK gathers the data on giving across the globe: helping strangers, donating money, volunteering to organizations and coordinated NGO efforts. According to those measures of philanthropy, Myanmar and the United States topped the list. View the full report, which shows that we all can be philanthropists and improve lives anywhere we find ourselves.

Brought to you by CAF Charity Fundraising

Brought to you by CAF Charity Fundraising

Wealthy Not Confident in Philanthropic Approach | Philanthropy content from WealthManagement.com

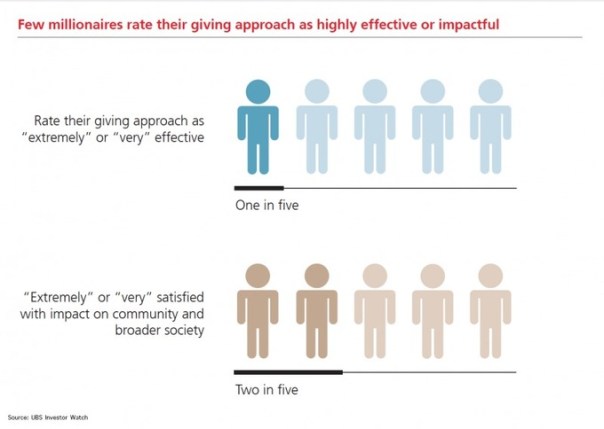

Over the past decade, wealthy investors have increased their philanthropic donations by 36 percent, yet only one in five feel their approach to giving is very effective.

Source: wealthmanagement.com

The key is strategic planning – and that goes for the “middle market” philanthropists as much as for the wealthy. You can plan your giving on purpose, with purpose. It takes some serious consideration and discernment. What are the values, beliefs and life lessons you want to share with others? What organizations and people embody that? How can you give effectively? What are all the abundant treasures you have to share (not just your bank account)?

This is National Estate Planning Awareness Week . . . planning being the key word here. This is an opportunity to look at our total financial situation and decide how we will spend our time, talent and treasure. We are challenged to look to see how we will use that treasure to make an impact beyond our own lifetimes.

I encourage all of you to started setting aside money in a “philanthropy account” and to be intentional about how you will use that money. The philanthropy account can be a simple bank account or a donor advised fund. The intentional, strategic plan for the long-term impact of that money can be foggy – contact me for discernment tools to help you gain clarity around the impact you want to make.

Nonprofits – these discernment tools can add great value to your donors’s lives and that of their families. Contact me for the complete program.

Your message has been sent

Estate & Charitable Planning Webinar

It’s National Estate Planning Awareness Week, and the American Endowment Foundation is hosting an introduction to estate planning that you should check out. Designed for individuals and their trusted advisors, this seminar will be a valuable first step in planning your life and legacy on purpose with purpose.

AEF is an independent charitable foundation that administers Donor Advised Funds. (See my SlideShare presentation on donor advised funds) AEF is a leader in providing useful tools and resources for the “middle-market” philanthropist.

In November, I will be speaking in Lancaster, Ohio with other professionals on this topic. While this mini-conference is geared especially to farmers and business owners, any one is welcome. Subscribe to this blog so that you can receive notification of the event date and registration information.

Does the over-researched donor spell the end of spontaneous philanthropy? | Philanthropy Daily

Source: www.philanthropydaily.com

A few weeks ago, we held a session on Donor Advised Funds and other ways that donors can plan their spontaneous philanthropy. This article is from the nonprofit fundraising perspective and sounds a thoughtful caution to fundraisers. How are you making sure that you are not pestering donors into silence? How can you take all you big data and filter it so that you are speaking only with donors who are ready and willing?

Your nonprofit’s long-term financial success depends upon you taking time to approach donors thoughtfully, strategically and respectfully.

Strategies and cutting-edge service providers are out there for you to access, if you know how. It’s not just for the large nonprofits any longer. You can access the knowledge and services with efficiency and high return on investment, no matter your organization’s size or mission.

contact me for a discussion and links to resources: unleashed.abundance@gmail.com

Undeniable Long-term Success

The Ice Bucket Challenge certainly caught our attention and generated a lot of short-term revenue for ALS. The same things happens with American Red Cross appeals when a natural disaster occurs. On a smaller scale, your events, galas, 5k runs and golf outings generate attention and a burst of short-term revenue.

But what is the secret behind REAL success in fundraising? How can you transform these short-term income generators into long-term, sustainable streams of revenue?

Join a group of people who are passionate about their nonprofit causes as we discuss how to tackle this big issue confidently and with remarkable results.

The event is October 1, 2014 at 7:30 p.m. EDT. (https://www.liveninja.com/event/undeniable-fundraising-success/)

For those of you on the West Coast of the USA and Canada, the event will be hosted on October 6, 2014 at 10:00 am PDT.

(https://www.liveninja.com/event/undeniable-fundraising-success-1/)

Who should spend time on this?

Any one responsible for the financial health of a nonprofit organization:

- Professional Fundraisers

- Board Members

- Volunteers

- Staff, including the Executive Director

What will you walk away with?

A basic plan that you will be able to implement immediately:

- A process to use events and promotions to secure long-term supporters and partners

- 3 key strategies to unify your action

- A system to begin to build the structure for on-going success in financing your cause.

BONUS: for all registered attendees, I will host on a FREE 1/2 hour one-on-one liveNinja session to go over their initial plan.

To prepare, I suggest you read Unleashed Abundance – The Fundraiser’s Manifesto (available at Amazon.com or fill out the request form below).

If you can’t make one of the events, contact me by filling out the form below.

Your message has been sent

Cheating Death

Never, ever give up.

Recently, Death came knocking on my door. I did not answer; it seemed like the smart thing to do. It worked.

Now, I have completed treatment for my abdominal cancer (Pseudomyxoma Peritonei, often referred to as PMP). I’m in remission, and my oncologic surgeon expects me to live a reasonably healthy, full life.

Despite the miraculous treatment outcome, I’m still a long way from normal. My recovery continues as I focus on healing, regaining strength, and putting on weight. While I concentrate on a return to good health, I will gradually re-engage in professional life between now and the end of the year.

I wish my progress were much quicker. However, as I look back over my shoulder, I realize that I’ve been on an extraordinary journey over the past seven months. Here’s a brief recap of what has happened:

February 2014 — Leading up to my routine…

View original post 1,042 more words

Fundraising’s Shiny Object Syndrome : New Social Velocity Blog Post

Source: us5.campaign-archive2.com

The ice bucket challenge is NOT a revenue stream – it’s a one-time infusion of capital. It’s similar to any other event or campaign that nonprofits engage in – bake sale, social media, a disaster, Holiday drive, etc. The key is capturing names and contact information and following up on the initial emotion and desire to help. Use the “event” to build a process for sustainable, regular revenue. Make it about meaningful philanthropy that is on-going.

Most nonprofits think they have a revenue / income problem and become so desperate for a quick and easy solution that they will try any gimmick. But they don’t really have an income problem – they have a clarity problem that is affecting their on-going revenue stream. Join one of our upcoming web calls to learn more about this approach to sustainable fundraising.

6 Best Ways to Make Storytelling Part of Your Nonprofit Culture – Clairification

Everyone loves a good story. Everyone. Which is why storytelling should be at the heart of your nonprofit’s strategic communications. I know ‘storytelling’ is a meme du jour. But that’s no reason to ignore it. Just because everyone else is doing it doesn’t mean you shouldn’t! There’s a reason these phrases become buzzworthy. In this […]

Source: www.clairification.com

Too often, the stories nonprofits tell about donors is this: how the donor made a gift and sometimes why. It’s about the mechanics of giving, especially if it’s large or a planned gift. It is rarely about the donor’s life experience or the change the gift is going to make on a future outcome. People are definitely looking for meaning and an experience of being alive – – good stories create an emotional desire to help. THEN the story gives the reader / listener a way to act upon that desire . . . and really good nonprofits can do that over and over again.

Copley Raff’s Giving Take: Beware of Charity Watchdog Groups and the Paradox of Shortsightedness

Source: copleyraff.blogspot.co.uk

Excellent points about long-term revenue generation and the dangers of simple formulas to evaluate complex situations. Many nonprofits of all shapes and sizes won’t invest in long-term revenue generation projects precisely b/c they are afraid of criticism in spending “too much” on fundraising. Developing a way to measure true transparency and wise practices is difficult. Wall Street analysts evaluating for-profit, public companies even have a difficult time and take things on a case-by-case basis. If we discuss the definitions of prudent strategic action then we will be able to advance meaningful philanthropy around the globe.